雅思大作文7分范文及解析:发展中国家是否引入外企

雅思大作文7分范文及解析:发展中国家是否引入外企

双边类大作文,社会类话题

Some people think developing countries should invite large foreign companies to open office and factories to grow their economies. Other people think the developing countries should keep the large foreign companies out and develop local companies instead. Discuss both views and give your opinion.

题目来源:2012年10月7日大陆雅思大作文

1

题目大意

有的人认为发展中国家应该邀请国外的大公司来入驻和开办工厂,这样有助于促进当地经济。另一些人认为发展中国家不应该让国外大公司进入,而发展当地企业。讨论双方观点并给出自己的看法。

2

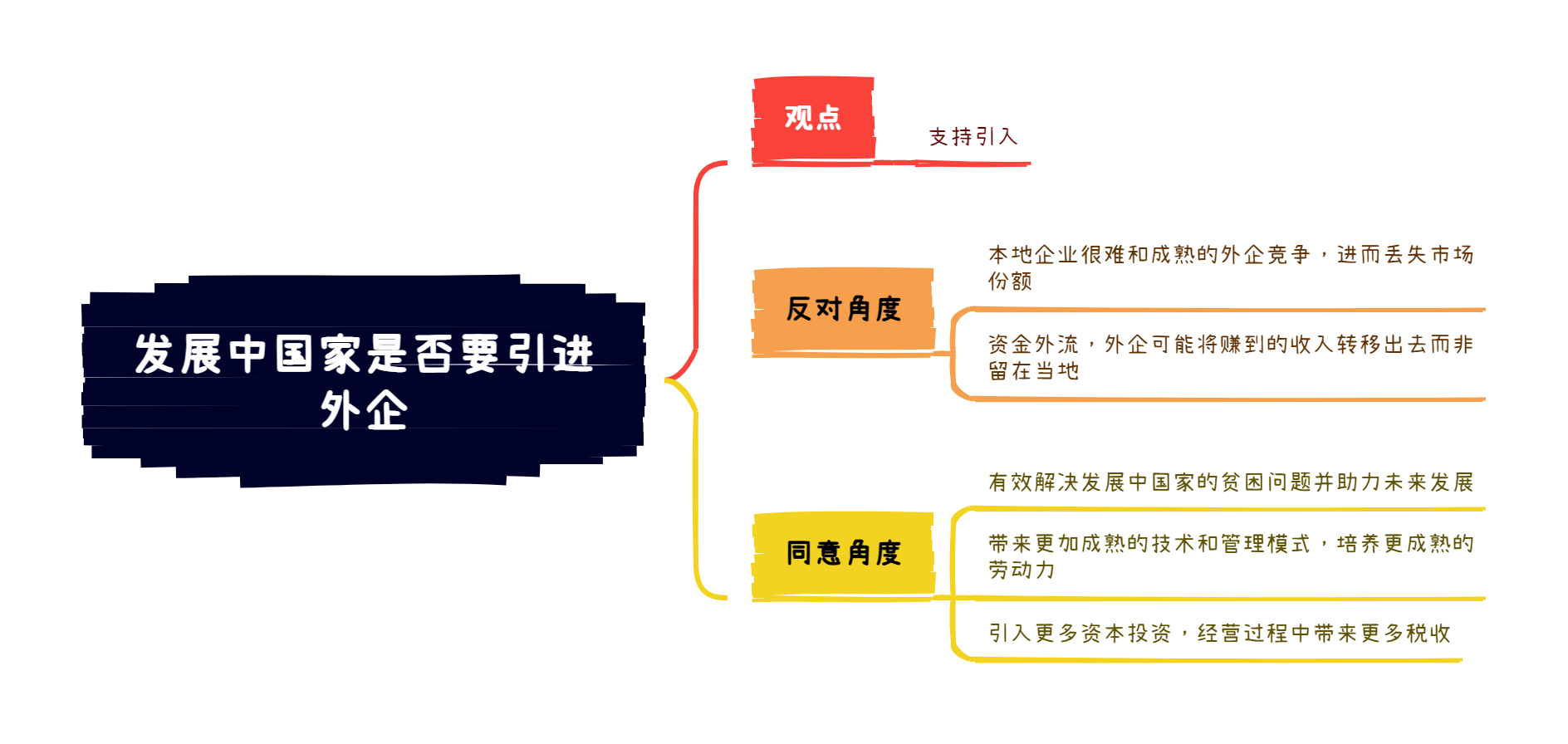

思路解析

这是一道双边类大作文,聊的是发展中国家是否应该引入外资开设工厂。双边类大作文,需要对每个观点分别表达同意或反对,最终的结论就是我的立场,可以是中立(双方都同意或都反对),也可以是单边支持某一方立场。审题时需要注意一点,题目讨论对象是“developing countries”和“large foreign companies”,需要考虑发展中国家和国外大公司的特性。下面,月半鸭和大家一起来看下具体观点。

首先来看同意的角度,有三方面原因。

一是引入大型外企能够带来经济效益和就业岗位。当外企进入时,往往需要大量的劳动力从事生产和运营,尤其是在制造业和服务业。这可以显著减少当地的失业率,从而带动经济增长。

二是能够本地技术升级和产业进步。对于发展中国家来说,外国大型公司在生产、管理和技术可能有先进的方法和经验。本土员工和管理者可以从中学习,从而提升本地行业的整体技术和生产效率。

三是能够带来更大的市场规模。当地产品能够被纳入外企的供应链后,它们也有机会被销售到全球各地,这将大大扩大当地产品的市场范围。

再来看后者的合理性,有两方面。

一方面引入外企可能会对本地产业和公司生存造成冲击。由于发展中国家的本土企业在资金、技术和供应链处于劣势,可能很难与更加成熟的外企进行竞争,进而导致本地企业失去市场份额,甚至整个产业被外资所垄断。

另一方面依赖外企会带来资金和经济安全的风险。外企可能会将其在当地赚取的利润转移到其总部或其他地方,导致本土失去大量的资本积累机会。同时,当地经济变得容易受到国际经济波动的影响,从而增加不稳定性。

3

提纲

4

高分范文示例

Undeniably, the influx of foreign investment presents a constellation of potential hazards and drawbacks. It is evident that a majority of multinational corporations strategically allocate their capital and establish their manufacturing facilities in developing nations, primarily with the objective of marketing their products or securing a significant market share. However, I posit that the advantages derived from this process are substantial enough to counterbalance the inherent risks associated with the transmigration of capital across international boundaries.

It is a foregone conclusion that domestic enterprises may confront a formidable challenge when colossal foreign companies penetrate the local market. Armed with extensive resources and formidable competitive prowess, these multinational entities can effortlessly gain market dominance, thereby marginalizing their competition, particularly small and medium-sized enterprises. Moreover, a matter of concern arises in the context of profit repatriation. It is crucial to acknowledge that numerous companies might not reinvest their earnings in the host nation, thereby inducing significant capital outflows from the country.

While it is improbable to altogether eliminate the aforementioned adverse effects, the introduction of overseas capital has demonstrated its profound efficacy in mitigating poverty and spurring development in less-developed nations. As foreign companies integrate themselves into the domestic market, they catalyze a transference of resources and a dissemination of knowledge, enhance corporate governance practices, and cultivate a more favourable investment climate. This invariably translates to benefits for the local industry, wherein diverse firms are granted opportunities for growth and expansion, along with access to innovative technologies and skillsets that augment workforce proficiency and productivity. Furthermore, the profits amassed by these foreign entities contribute significantly to the tax revenue of recipient nations, notwithstanding any preferential tax policies. These revenues can, in turn, be utilized to stimulate economic growth directly, or allocated towards infrastructural enhancements such as power projects, telecommunications, or modernization efforts aimed at attracting further investment.

In summation, the potential risks associated with foreign investment should not overshadow its promising prospects, particularly in the milieu of globalization. The facilitation of capital flow across borders is not merely a desirable strategy, but indeed an essential and unavoidable one for less developed nations aspiring for prosperity.

范文作者:朱雅婷 & Sophia

5

相关词汇和语法结构

Constellation of potential hazards 一系列潜在的风险

Strategically allocate their capital 战略性地分配他们的资本

Formidable challenge 艰巨的挑战

Colossal foreign companies 庞大的外国公司

Effortlessly gain market dominance 轻松地获得市场主导地位

A matter of concern 一个令人关注的问题

Profit repatriation 利润回流

Inducing significant capital outflows 引发大量资本外流

Profound efficacy 深远的效力

Mitigating poverty 缓解贫困

Spurring development 推动发展

Integrate themselves into 融入

Dissemination of knowledge 知识的传播

Augment workforce proficiency 提高劳动力熟练度

Notwithstanding any preferential tax policies 尽管有任何优惠税收政策

Infrastructural enhancements 基础设施的提升

Promising prospects 充满希望的前景

Aspiring for prosperity 渴望繁荣

来源:雅思情报圈

以上就是新航道南京雅思培训机构小编分享的雅思大作文7分范文及解析:发展中国家是否引入外企的全部内容,大家可以参考一下,更多有关雅思考试的问题,欢迎咨询新航道老师。